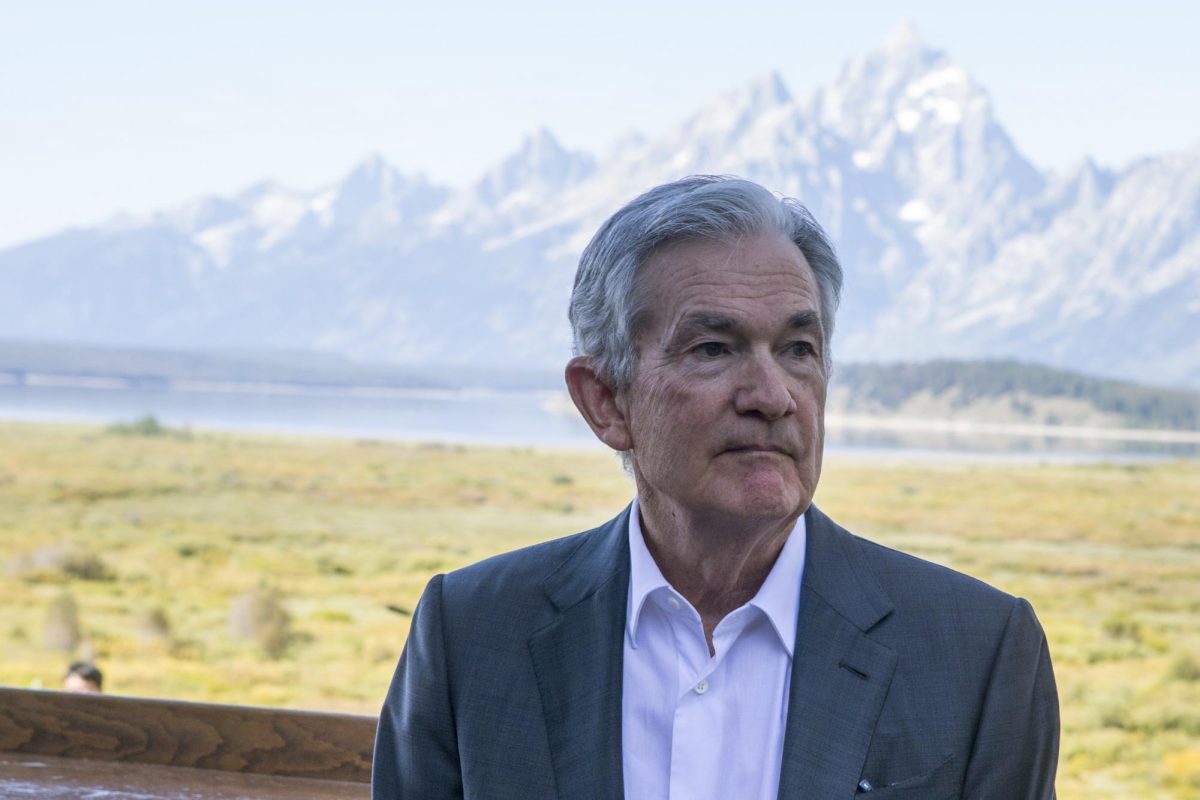

I never thought that I would become like my parents: the people who stand at the checkout line at grocery stores and make small talk about the rising prices. This was until I bought a bag of groceries at Price Chopper last week. The Wall Street Journal reported that while things have gotten cheaper lately with August bringing about a deceleration in the rate of core inflation to 4.3 percent in comparison to July’s 4.7 percent, the question at the heart of this article remains the same: How well have Jerome Powell’s anti-inflationary policies held up?

Inflation, the steady increase in the general price level of goods and services, can erode the purchasing power of consumers and disrupt economic stability. The goal of the Federal Reserve has been a lofty target — reducing inflation to a little over two percent, as reported by Reuters. As any economics major on this campus could tell you, the first step to fighting inflation is a hike in interest rates which would correspondingly lower the supply of money in the economy. Federal Reserve Chair Jerome Powell has followed this exact strategy, leading to the central bank’s “most aggressive tightening cycle in a generation,” according to Reuters. So far, Powell has maintained his word, leading to 11 consecutive increases in rate hikes since March 2022, totaling an increase of 5.25 percent. While this has led to a decrease in inflation, Powell walks a thin line to not make policy so restrictive that it causes unemployment to balloon up.

Government officials are split on whether to raise interest rates further, as reported by Bloomberg. Some worry that more rate hikes could make borrowing money harder and more expensive, which might slow down the economy. Others are concerned that if the economy keeps growing fast, inflation might not go down as expected unless the Fed raises rates again. Jerome Powell has spoken about both concerns, mentioning that things like borrowing money and lending rules have gotten tougher lately, which usually means less spending and slower economic growth. When interest rates go up, it often makes stock prices drop because investors like bonds more. Additionally, rising interest rates can make existing bonds more valuable, which is the opposite of what happens with stocks. So, it’s a tricky balancing act for policymakers as they try to manage the economy while keeping an eye on inflation and the financial markets.

Caitlyn Ostroff for The Wall Street Journal writes, “Stocks moved between gains and losses after Powell’s speech, before closing higher. The S&P 500 and the Dow Jones Industrial Average each climbed 0.7%, and the Nasdaq Composite rose 0.9%. The yield on the benchmark 10-year Treasury note increased to 4.239% on Friday, from 4.234% on Thursday.” Ostroff explains how this data shows that, for the first time in two years, inflation is now leading to wage increases, which accounts for Americans’ higher retail spending in July.

If certain predictions hold, the stock market may be set for further growth. Historical data analyzed by the financial research firm CFRA reveals that following the Federal Reserve’s last six instances of raising interest rates, the S&P 500 saw an average increase of 13 percent from the final rate hike to the first rate cut in the subsequent cycle. However, not everyone shares this optimistic outlook. The Wall Street Journal explains that some investors, adopting a more cautious stance, believe that the eventual rise in interest rates will eventually tighten economic conditions, potentially leading to an economic downturn. It’s worth noting that the S&P 500 has already recorded impressive gains this year, as reported by Reuters. This was, in part, bolstered by the resilience of the U.S. economy in the face of increasing interest rates.

So the final question remains: Why have stock prices not correspondingly reduced with an increase in interest rates? An explanation for this could theoretically come from stocks that were overvalued in the first half of the 2023 market rally. Price to Earnings (P/E) is a prominent financial indicator used to indicate the relative value of a stock price. The stocks that have largely done well in this period are primarily technology and secular growth companies that may be considered overvalued from a valuation perspective. Investors may be more convinced of the future earning potential of these stocks which thrived in a lower interest rate environment instead of the grimmer reality of the pricing multiples decreasing with time as the earnings do not live up to expectations.

Another reason for these relatively high stock prices could be companies issuing debt in 2020-21 and slowly rolling it over time instead of issuing new debt. Currently, the debt issued would be more expensive and would cut down into a larger share of the corporate earnings. This would bring the overall price of the stocks down.

As Powell has specified, the Federal Reserve needs to “proceed carefully” with increasing interest rates, as it’s a thin line between reducing inflation and increasing unemployment as well as lowering the price of the stock market. Only in the future, with the benefit of hindsight, will we be able to see whether he has won the fight against inflation.